Introduction

With the announcement of substantial pay increases for UK teachers and NHS doctors in 2025, attention has turned to the budget. Can the UK government truly afford such bold moves? This article explores how the UK Public Budget 2025 has been structured, the implications of allocating billions to public sector wages, and whether this is financially sustainable.

To understand the full context, see our pillar article on the UK Teacher and Doctor Pay Rise 2025.

Table of Contents

Overview of the 2025 UK Public Budget

The 2025 budget represents one of the most ambitious public spending plans in recent years. With inflation stabilizing and tax revenues increasing, the government has room to maneuver—but only slightly. Spending priorities have shifted toward healthcare, education, and public safety.

Allocation for Public Sector Salaries

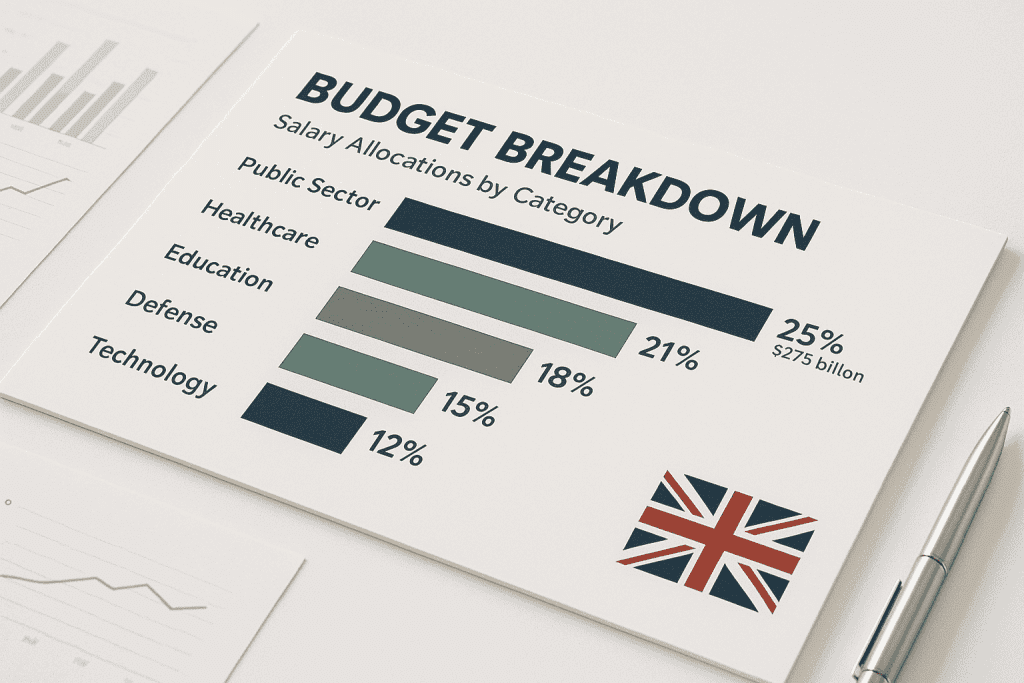

Breakdown of Salary AllocationsBreakdown of Salary Allocations

According to the Treasury, over £10 billion has been earmarked for public sector pay increases:

- £4.3 billion for NHS staff

- £3.1 billion for teachers and education staff

- £2.6 billion for police, social workers, and other essential personnel

This reallocation marks a significant investment in frontline services but also triggers concerns about where funding will be reduced elsewhere.

Budget Balance vs. Borrowing

Although some of the funding is backed by increased tax revenues, the remainder depends on borrowing. The UK’s public debt-to-GDP ratio currently sits at 97%, and economists warn that excessive borrowing could strain future budgets.y sits at 97%, and economists warn that excessive borrowing could strain future budgets.

Financial Risks and Trade-Offs

The UK Public Budget 2025 is not without its financial caveats. While the headline-grabbing salary increases appeal to both public sector employees and the general public, the implications of such major spending need close scrutiny.

Cuts in Other Departments

To balance the UK Public Budget 2025, the government has opted to redirect resources from other departments. Notably, transportation budgets have been frozen, green energy initiatives have been paused, and overseas development aid has seen a noticeable reduction. These trade-offs are seen by some as short-term measures that may have long-term strategic costs, particularly in sustainability and global diplomacy.

Inflationary Concerns

A significant portion of economists argue that the salary hikes introduced under the UK Public Budget 2025 could contribute to inflation. Increased disposable income among public sector workers may drive up consumer demand, but if productivity and supply don’t keep pace, price levels may rise. Additionally, inflation can erode the very wage increases meant to help workers in the first place, making this a delicate balancing act for policymakers.

Interest Rate Pressures

To fund the UK Public Budget 2025, the government has significantly ramped up borrowing, prompting serious discussion about the economic consequences of this fiscal approach. While the budget prioritizes investments in public services, infrastructure, and economic recovery, its heavy reliance on debt is raising red flags.

Economists warn that the surge in government borrowing could put indirect pressure on the Bank of England to raise interest rates in order to manage inflation and maintain financial stability. If rates rise, the cost of mortgages, business loans, and government bonds will likely increase—impacting everyday households, entrepreneurs, and investors alike.

For families, this could mean higher monthly mortgage repayments; for businesses, reduced access to affordable credit; and for investors, more volatility in the bond markets. While the budget’s intentions are broadly supported, critics caution that without a clear long-term debt management plan, the ripple effects of rising borrowing could destabilize the UK economy over time.

Public Reactions and Political Debate

The UK Public Budget 2025 has triggered a wave of debate from various corners of society and government. While the intent to reward public servants is clear, the reactions highlight a nation divided over fiscal priorities.

Support from Unions and Voters

Unions representing teachers and NHS doctors have welcomed the pay rise measures as long overdue. For many frontline workers, the UK Public Budget 2025 is seen as a long-awaited recognition of their commitment and sacrifice, especially in the wake of the COVID-19 pandemic. Public opinion polls suggest strong support for the increased spending on healthcare and education, with many citizens viewing it as an investment in the nation’s future.

Criticism from Fiscal Conservatives

Not everyone is impressed. Fiscal conservatives, opposition leaders, and economic think tanks have warned that the UK Public Budget 2025 is overly optimistic. The Office for Budget Responsibility (OBR) has pointed out that such spending could lead to unsustainable debt levels. They argue that while the intentions are noble, the budget lacks detailed plans for offsetting the increased expenditure with revenue, which could put the UK’s financial credibility at risk. As the debate unfolds, the UK Public Budget 2025 continues to be both praised and scrutinized across party lines.

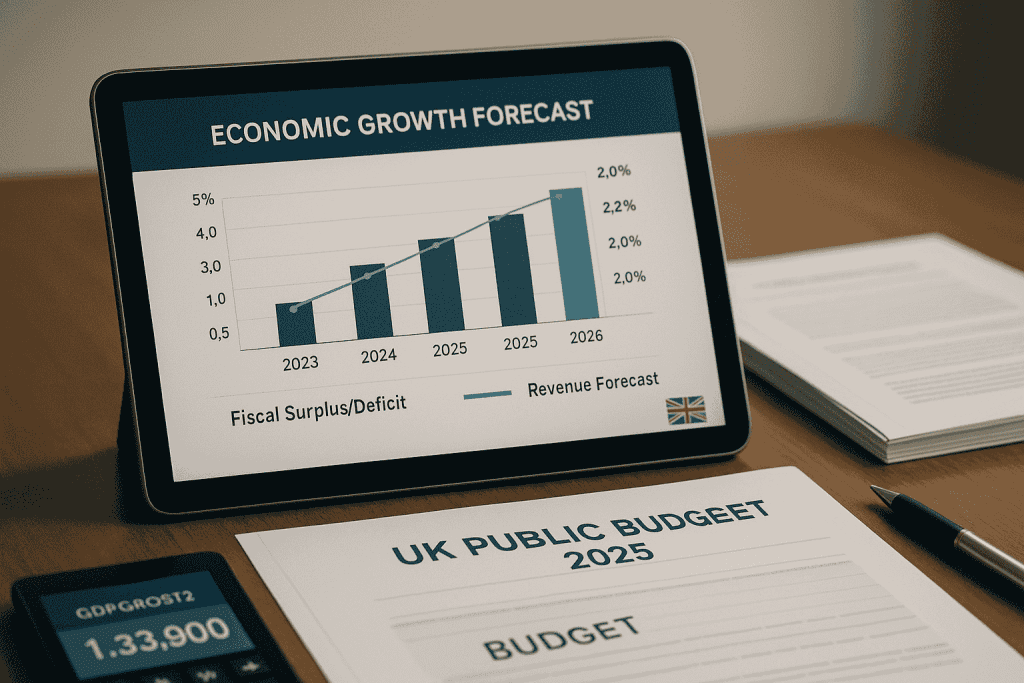

Economic Outlook and Forecasts

The economic outlook tied to the UK Public Budget 2025 is cautiously optimistic but fraught with variables. Economists forecast a modest GDP growth of around 1.9% for 2025, which may provide limited room for sustained salary increases and social spending. However, whether this projected growth can absorb the scale of financial commitments made in the UK Public Budget 2025 remains a subject of ongoing debate.

Growth vs. Obligations

The critical question is whether the anticipated economic expansion will outpace the growing demands on public finances. With the UK Public Budget 2025 allocating substantial resources to public sector wages, any shortfall in growth could necessitate cuts in other sectors or tax hikes. Forecasts by the Office for Budget Responsibility indicate that while the current framework is viable, it is highly sensitive to inflation, productivity, and labor market participation.

Global Economic Factors

Another factor that will shape the success of the UK Public Budget 2025 is the global economic environment. Trade disruptions, energy prices, and geopolitical tensions could impact the UK’s economic performance. If exports decline or energy costs spike, this could put additional pressure on the Treasury’s revenue base, making it harder to maintain spending commitments.

Calls for Structural Reform

Experts from the Institute for Fiscal Studies argue that the UK Public Budget 2025 may also need to be accompanied by structural reforms. These could include streamlining government departments, revising pension obligations, and modernizing procurement policies. Without these efficiency improvements, some economists warn that the budget could place undue stress on the nation’s financial stability.

Long-Term View

While the UK Public Budget 2025 reflects a strong commitment to public welfare, its long-term success depends on multiple moving parts. Fiscal discipline, economic resilience, and policy flexibility will be key to determining whether the salary hikes announced in 2025 are sustainable in the years to come.

FAQs

Q1: Can the UK budget support long-term pay increases?

A: Not without continued growth or new revenue sources. Current allocations rely partly on borrowing.

Q2: Will this budget cause tax increases?

A: It’s possible. If growth slows, the government may need to adjust tax rates or broaden the tax base.

Q3: What are the main risks?

A: Inflation, increased debt, and cuts to non-priority sectors.

Call-to-Action (CTA)

Want to stay informed about how UK policy impacts public services and salaries? Subscribe now for expert updates and budget breakdowns.